As I begin

to assess how I’ve done as a covered call investor with the Rescue My IRA

approach this year, I thought I might start with a pause and reflect on my two

long-standing positions: the 700-share GLW

position, and the 500-share CSX positions.

They currently have May 2013 covered calls written on them, and I have

held the shares pretty much since the beginning of the account.

As I

reported last month, when I adjusted them with the May roll-out, I have earned

a 12% annualized return on them – easily verifiable, since I’ve held them for

more than a year. Now, I’d rather that

the positions on these shares were a bit closer in, but given the markets ups

and downs, sometimes I take what I can get.

We’ll start

first with a look at the basis for the shares.

GLW – 700 shares,

purchased in several lots at a total cost of $9,241.88, or $13.20 per share

CSX – 500 shares,

also purchased in a couple of lots, at a total cost of 10,861.01, or $21.72 per

share

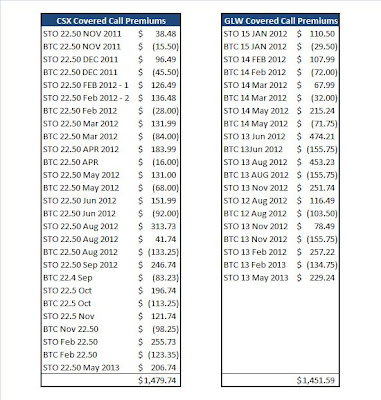

Over the

course of holding these shares, I have written more than 10 contracts on each

of them, as summarized in the table

below:

Calculated

on their respective bases, the premiums I’ve generated on these shares work out to 15.7% on GLW and 13.6% on CSX. These

holdings have met my goals of a 12% annualized return on the basis of the

covered call premiums alone; however,

they’ve also returned dividends along the way, since one of my screening criteria is a requirement for a dividend payment.

My goal on this criteria is to find shares that pay between 2 and 5% on an annual basis. For GLW, assuming I hold the shares through

the current May contract, I will have received a total of $276.00 in dividends,

adding another 3% to the return, for a total of 18.7%. On CSX, the dividend amounts are $338.00, or

3.1%, making a total of 16.7% on these shares.

The final

component of returns in the Rescue My IRA account is capital gains on the

shares. On the GLW side of the ledger,

here is where we have a little bit of a problem – at the current strike price

of $13 per share I will take a capital loss on the position of about $160. That will reduce my absolute return to 16.96%

- it still averages out to 12.14% annualized for the position over the course

of holding it approximately 510 days.

As for CSX,

this stock has been a steady performer in this department – I’ve been writing

covered calls at a $22.50 strike price since I first bought the shares, a price

that will yield a capital gain of just about $371 on the position. That works out to an absolute return of

20.15%, which annualizes to 14.42% over the 510-day holding period, slightly

better than my goal of 12% annualized.

One of the

advantages of using a portfolio model, as I do here with the Rescue My IRA

account, is that you’ll have a few positions that exceed your goals, some that

fall short, and some that perform right on target. The GLW and CSX positions are examples of

positions that have worked out as planned.

Next week, I’ll

post my December monthly results and then write an annual results post. I’ll follow those with a look at three trades

where things didn’t go as planned, attempting to assess where my strategy went

wrong. I also have five positions where

my goals were exceeded – even though the positions were short-lived – and I

will put together a recap post on them as well.

Here’s to

more positions that perform as reliably as GLW and CSX have for me in 2012!

No comments:

Post a Comment