I’m writing my month end post for December a

few days early this year, since I’ve got a fairly busy couple of days ahead of

me and I plan to put up a few retrospective posts during the first week of

January as well. So the account value I

am reporting below is what was shown on Friday 12/28 shortly after the markets

opened; I’ve also estimated the interest I’ve earned on cash returns at the

rate I’ve been averaging this year, a laughable 7 cents. For the most part, this will give an accurate

presentation of the results – and I will correct anything where necessary when

I do the year-end review post.

The account performance this month is a “good

news – bad news” story. I had a couple

of interesting trading opportunities that performed well, and I collected

$423.00 in dividends – those are the good news.

On the less desirable side, the HPQ shares I held were called away on

their December expiry date – I’d forecasted this in my November results, and I

took a hit on the shares – that would be the bad news, and I will start with

that.

As I mentioned in my November results post, I

believe I rushed into the HPQ investment.

I compromised my trading plan criteria by buying an S&P 3-star

stock, albeit one with a great brand name.

It’s a turnaround play, but the shares have continued to show poor

financial results – they made a bad acquisition last year, taking an earnings

charge this year and having to make up for it in future quarters – all of which

beat the share price down.

I worked hard to try and stay above water on HPQ,

but I decided to sell a Dec 12 last month to pick up a little cash, and then

let the stock be called away with a capital loss. It is probably my biggest capital loss on a

position of the year, and it is a lesson learned I’ll feature in the annual

recap post.

For good news, there is that collection of

dividends - $423.00, a monthly return of 0.33% on the account value. That far exceeds what you get from the bank,

and the accumulation of all the dividends I collected this year is certainly a

part of why the account still shows a positive return for the year.

On the covered calls side of things, I had two

positions that had December contracts – ITW and SWK – and both were forecast to

go ex-dividend during the month.

Interestingly, one-half of the ITW position was called on the ex-date at

a gain of $354.44; I collected the dividend on the other half and rolled it out

to January. After the ex-date for SWK I

bought to close the option contract there, and then rolled it out and up – also

to a January contract. I’m in a good

spot with these shares and both positions are performing as I want them to,

generating a 12% annualized return.

On the hypothetical side of things, if I

exclude HPQ from my monthly calculations – acknowledging it as a mistake I will

try not to make again, between the covered call premiums, dividends, and share

gain on ITW, I earned a return of $1,374.80 on the account – that’s more than 1

percent for the month, and meets my goal for Rescue My IRA. I’ll just need to work on making sure I

minimize special situations like that one in the future!

So,

despite the good news – bad news theme, here are the statistics for December

2012:

Account Status:

Account Status:

·

Total Account Value, 12/28/2012

Market Open: $131,252.12

·

Total Cash Reserve, 12/28/2012

Market Open: $6,987.15

·

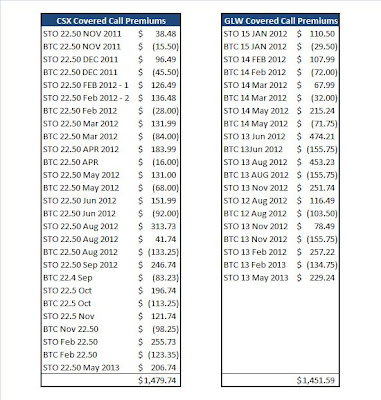

Core Stock Positions

(as of 12/31/2012): AFL (100 shares), CAT (100 shares), CSCO (500

shares), CSX (500 shares), DOW (300 shares), GLW (700 shares), HAL (300

shares), ITW (100 shares), LNC(400 shares), MSFT (300 shares), SWK (100

shares), SPLS (700 shares), URS (400 shares), WAG (300 shares)

Performance Metrics:

Option Premiums Collected (net, month of October): $597.36

Capital Gains Collected (net, month of October): -$3,279.66

Dividends Collected

(recognized on the ex-date): $423.00

Interest on Cash Reserve (total): $0.07

Total, Absolute Return: -$2,259.23

Absolute Return, Percentage Basis: Negative

Annualized Return, Percentage Basis: Negative

Interest on Cash Reserve (total): $0.07

Total, Absolute Return: -$2,259.23

Absolute Return, Percentage Basis: Negative

Annualized Return, Percentage Basis: Negative

Next Month To-dos:

January is a slow

month for dividend, and I have only one position with a declared ex-dividend

date coming up – LNC. They pay $0.12 per

share, so assuming the shares aren’t assigned on January 8 (I have a January

covered call written on them), I will collect $48.

I also have quite a

few options expiring next month: CAT,

HAL, ITW, LNC, SWK, and WAG. Some are

currently in the money as I write this post, and some aren’t. Plus there is the market complexity that will

result from the idiotic “fiscal cliff” situation – so we’ll see how it

goes.

Unless I have trades

to report, the next few posts will be retrospectives on Rescue My IRA trading

activities and results for the 2012 calendar year.

Happy new year to all,

and best wishes for meeting your own financial objectives!